Obtain Your Home Loan Questions Responded To In This Article

Content written by-Cowan HeadWhen people think of mortgages, they often imagine pushy lenders and high interest rates. When you know a lot about the process of getting a mortgage, you'll find that these negative thoughts leave your mind completely. To learn all you can, read the content below which has been written by experts to provide you with the best advice available.

Prepare for the home mortgage process well in advance. If you want a mortgage, get your finances in order right away. That will include reducing your debt and saving up. Waiting too long can hurt your chances at getting approved.

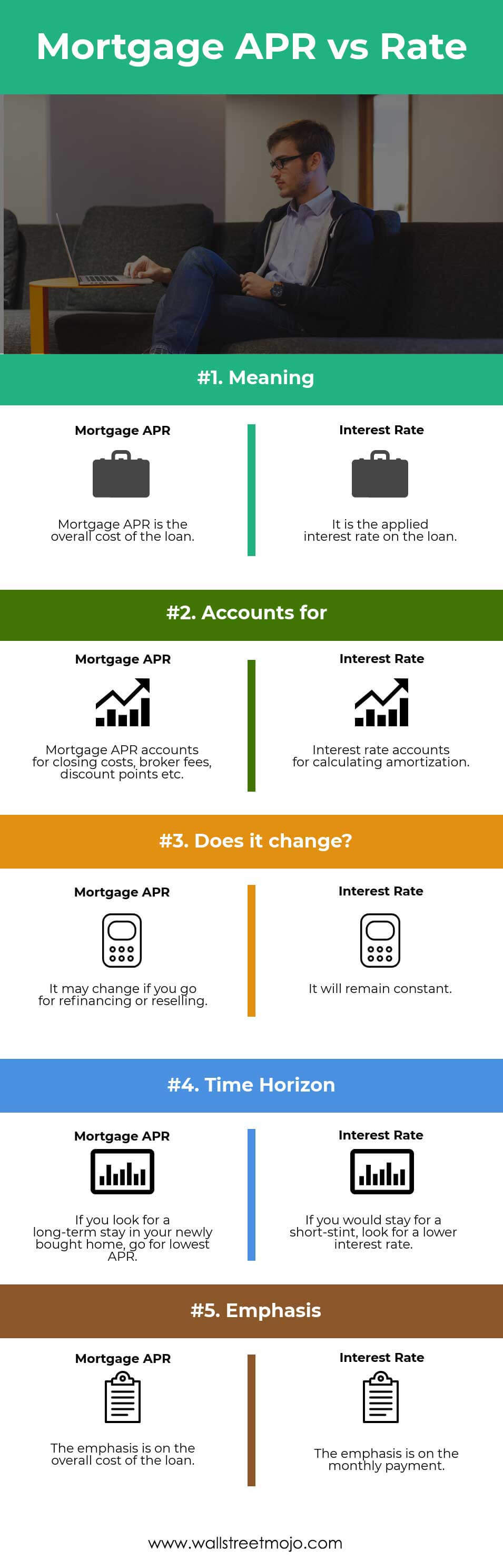

A fixed-interest mortgage loan is almost always the best choice for new homeowners. Although most of your payments during the first few years will be heavily applied to the interest, your mortgage payment will remain the same for the life of the loan. Once you have earned equity, you may be able to refinance your loan at a lower interest rate.

If you are a veteran of the U.S. Armed Forces, you may qualify for a VA morgtage loan. browse around this site are available to qualified veterens. The advantage of these loans is an easier approval process and a lower than average interest rate. The application process for these loans is not often complicated.

Get mortgage loan estimates from at least three different mortgage lenders and three different banks. By shopping around, you may get a lower interest rate, pay fewer points and save money on closing costs. It's almost always preferable to get a fixed interest rate. With variable rates, you may not know from month to month what your mortgage payment will be.

Before talking to a mortgage lender, organize your financial documents. You will need to show proof of income, bank statements and all other relevant financial information. When you have these ready in advance and organized, then you are going to speed up the application process.

Make sure that all of your loans and other payments are up to date before you apply for a mortgage. Every delinquency you have is going to impact your credit score, so it is best to pay things off and have a solid payment history before you contact any lenders.

Although using money given to you as a gift from relatives for your downpayment is legal, make sue to document that the money is a gift. The lending institution may require a written statement from the donor and documentation about when the deposit to your bank account was made. Have this documentation ready for your lender.

Read the fine print of your mortgage contract before signing. visit my webpage find out too late that their fixed rate loan has a balloon payment tied to the end of the loan contract. By reading over the contract you can ensure that you are protected throughout the entire loan term.

When considering a home mortgage lender, check the lender's record with the Better Business Bureau (BBB). The BBB is an excellent resource for learning what your potential lender's reputation is. Unhappy customers can file a complaint with the BBB, and then the lender gets the opportunity to address the complaint and resolve it.

Do not allow yourself to fall for whatever the banks tell you about getting a home mortgage. You have to remember that they are in the business of making money, and many of them are willing to use techniques to suck as much of that money out of you that they can.

A good credit score is essential if you want to finance a home. If your score is below 600 you have some work to do before you can hope to purchase a home. Begin by getting a copy of your credit record and verifying that all the information on it is correct.

Ask those close to you to share their home mortgage wisdom. They may be able to help you with information about what to look for. A lot of them could have had a bad time with lenders so that you know who you should be avoiding. When you talk to more people, you're going to learn more.

Look closely at lenders. There are many companies willing to lend you money to finance your home. They are not all equal. Look into the reputation of the lender and try to talk to people who have their loans through them. Reputations are hard to hide, and you will want to know how your potential lender handles business.

Compare interest rates offered by your current lender with those offered by other banks. A lot of online institutions offer lower rates. It might work in your favor to discuss this with your banker.

If you can pay more every month, think about a 15 or 20 year loan. With the shorter loan term you get reduced interest rates that allow you to pay it down much quicker. You are able to save thousands of dollars in the end.

Be careful when shopping home mortgages online with different lenders, because a lot of them aren't so different at all. Many of these lenders are all owned by the same companies and thus applying with lender B and C, if they're owned by A, is just a waste of time. Find out who owns the lending branches before applying.

Look online for financing for a mortgage. You no longer have to go to a physical location to get a loan. A lot of reputable lenders have begun to offer mortgage services online, exclusively. They have the advantage of being decentralized and are able to process loans more quickly.

Most people have no idea about the mortgage process. The tips that have been explained to you can help simplify the process. Keep these tips in mind and use them to guide you successfully towards securing a home loan.